With the elections done and dusted and not many changes in terms of the names and faces that are around - can anyone explain to me why we are not seeing any positive signs in the property sector ?

I guess the answer is a very simple one - the uncertainty and sluggishness in the property sector had nothing to do with the elections in the first place. The issues we are now facing were in the making for a number of years now and the chickens have finally come home to roost.

Fact is our economy has serious structural issues caused by years of low growth, high unemployment, low business confidence, ever present political uncertainty with all the associated underlying tensions and just plain criminality on an industrial scale like we have never seen before.

Rentals in the property sector have also for a number of years moved sideways and certain sectors like the office market that can't achieve any growth at present with vacancies soaring and landlords getting very nervous. Speak to any banker, valuer, broker or property developer and ask them if they would touch the office sector at the moment and the answer would be the same across the board. "Not unless we have a very solid tenant that commits for a very long time - will we develop anything in the office sector" .

Talking about solid tenants - those are few and far between with every business in SA now under serious profit pressure and nowadays even the once mighty corporates and darlings of the JSE have difficult times in making profits like before. Imagine if you have developed a major corporate head office or renting regional offices to one of those who's share prices have tumbled to levels not seen in 10 years? I can imagine that there are a few developers and lenders around that have to take a something before bedtime to get a good nights rest in.

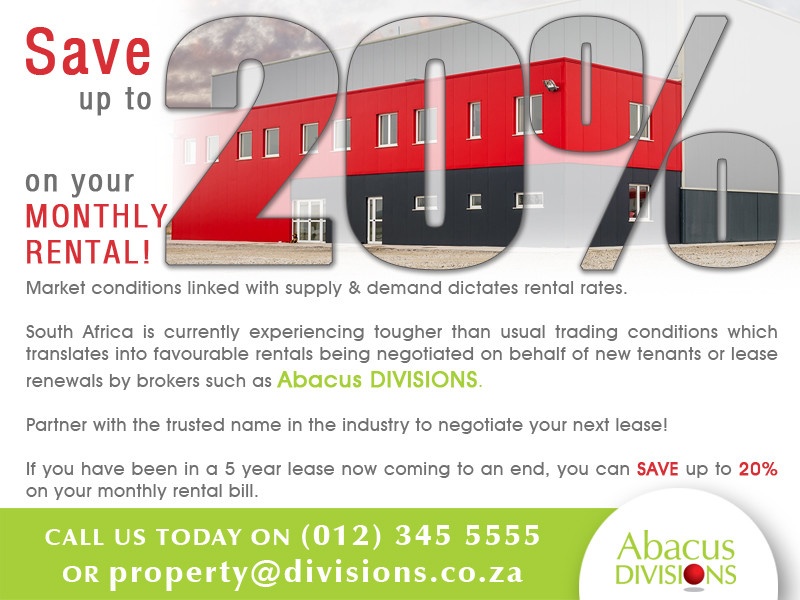

We have all seen the revelations by listed property groups like Redefine and others that have written about rental growth being flat at the moment and that rental re-negotiations are indeed tough. We see in our own broking business that tenants are again in the driving seat and they want to pay up to 20% less rental than before. Some rental agreements revert back to where they've started 5 years ago ! Imagine no growth after 5 years - this cant be real.

What can you do, not to get hurt by the current downturn? My advice has always been that loosing a tenant is very expensive business and you should do anything to try and keep a (paying) tenant - at least in this market we are in. Switching costs are high and vacancies cost money - then once you find a replacement tenant, you're in for expensive tenant installation, broker commissions and often associated with rent free and beneficial occupation periods. If you have a tenant that is struggling to pay, make a deal - run a discount for a few months and then revert back to your rentals after 3 or 5 months. If the tenant cancels the agreement, you might end up paying many times more than the costs of the discount. And through this small gesture you might just bought yourself a tenant for life!